NOTE: This is a Premium-exclusive stock report, originally for our Premium Access members only, but we’re giving this to you free! To view other FREE stock reports, click here. To get full access to all Premium-exclusive reports you won’t find anywhere else, upgrade to Premium Access for as low as P399.00 a month!

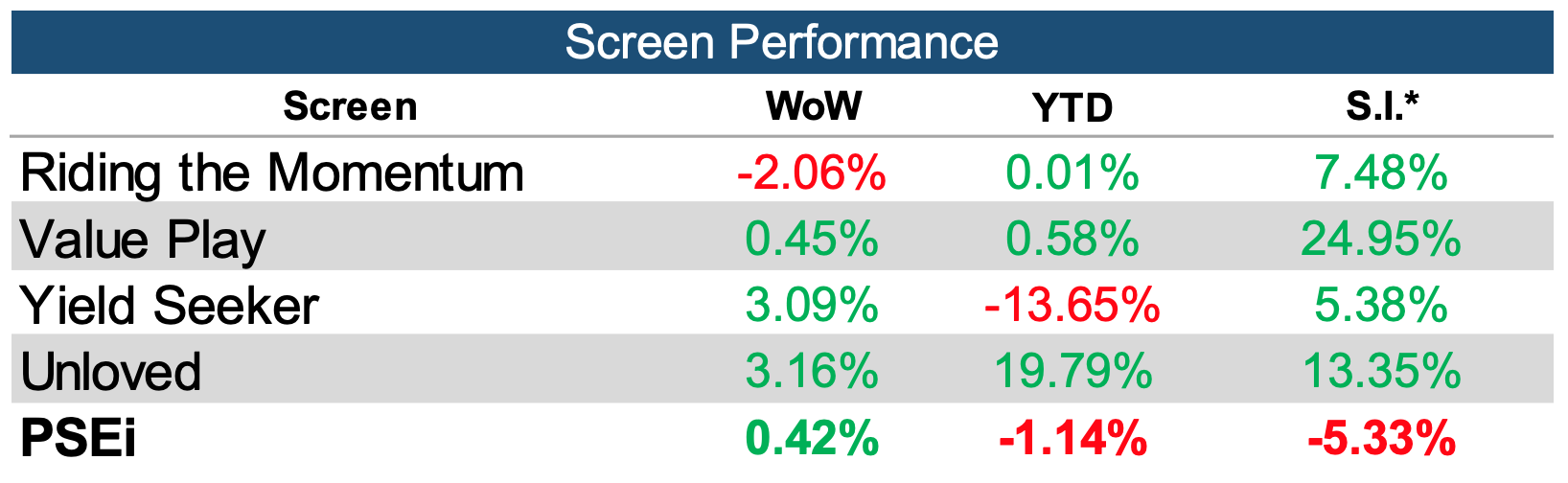

Performance of the 4 Model Portfolios

Check out below how each of the recommended model portfolios fare vs. the PSEi week-on-week (WoW), year to date (YTD), and since inception (S.I.).

*Week-on-week (WoW) = Performance vs. the previous week

*Year to date (YTD) = Performance since December 14, 2022

*Since inception (S.I.) = Performance since the start of the model portfolios on November 24, 2016

How to Use the Model Portfolios

1.) First, choose your preferred portfolio among the four based on your personal investment goal and risk appetite. You may choose to follow one, two, three, or all four model portfolios below as long as they fit your investment personality.

2.) Buy, hold, or sell the stocks as recommended every week in each model portfolio.

3.) Regularly monitor changes in the model portfolios to see which stocks have been removed or added each week.

That’s it!

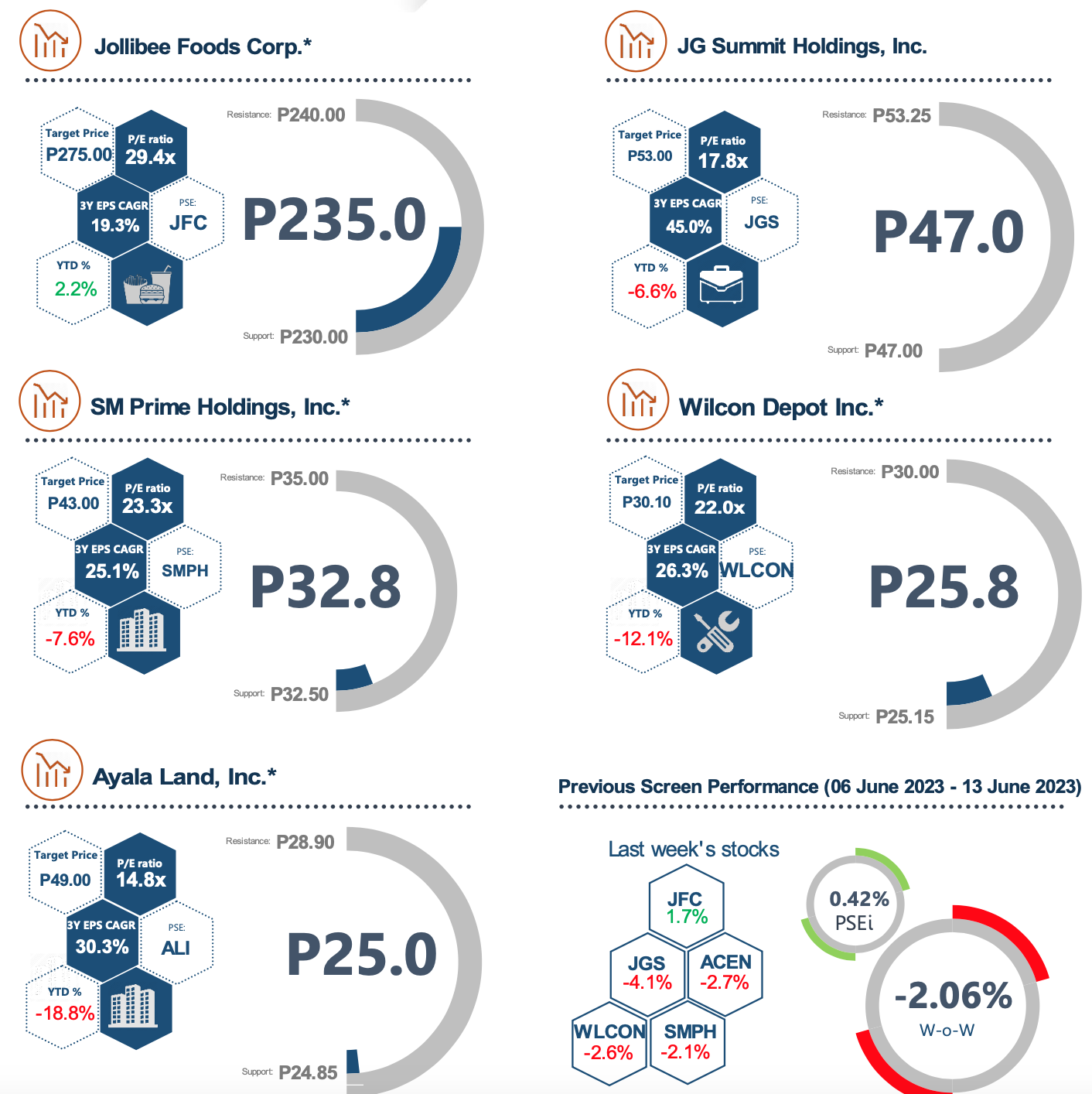

Model Portfolio #1: Riding the Momentum

This model portfolio is comprised of well-established companies with sustained profitability and high earnings expectations. These stocks are characterized as having high Earnings per Share (EPS) growth and high Price-to-Earnings (P/E) ratio.

| Riding the Momentum model stocks portfolio |

| 1. Jollibee Foods Corp. (JFC) |

| 2. JG Summit Holdings (JGS) |

| 3. SM Prime Holdings (SMPH) |

| 4. Wilcon Depot Inc. (WLCON) |

| 5. Ayala Land Inc. (ALI) – Newly added to the model portfolio this week |

SELL (Removed from last week’s portfolio): AC Energy Corp. (ACEN)

BUY (Newly added to the portfolio this week): Ayala Land Inc. (ALI)

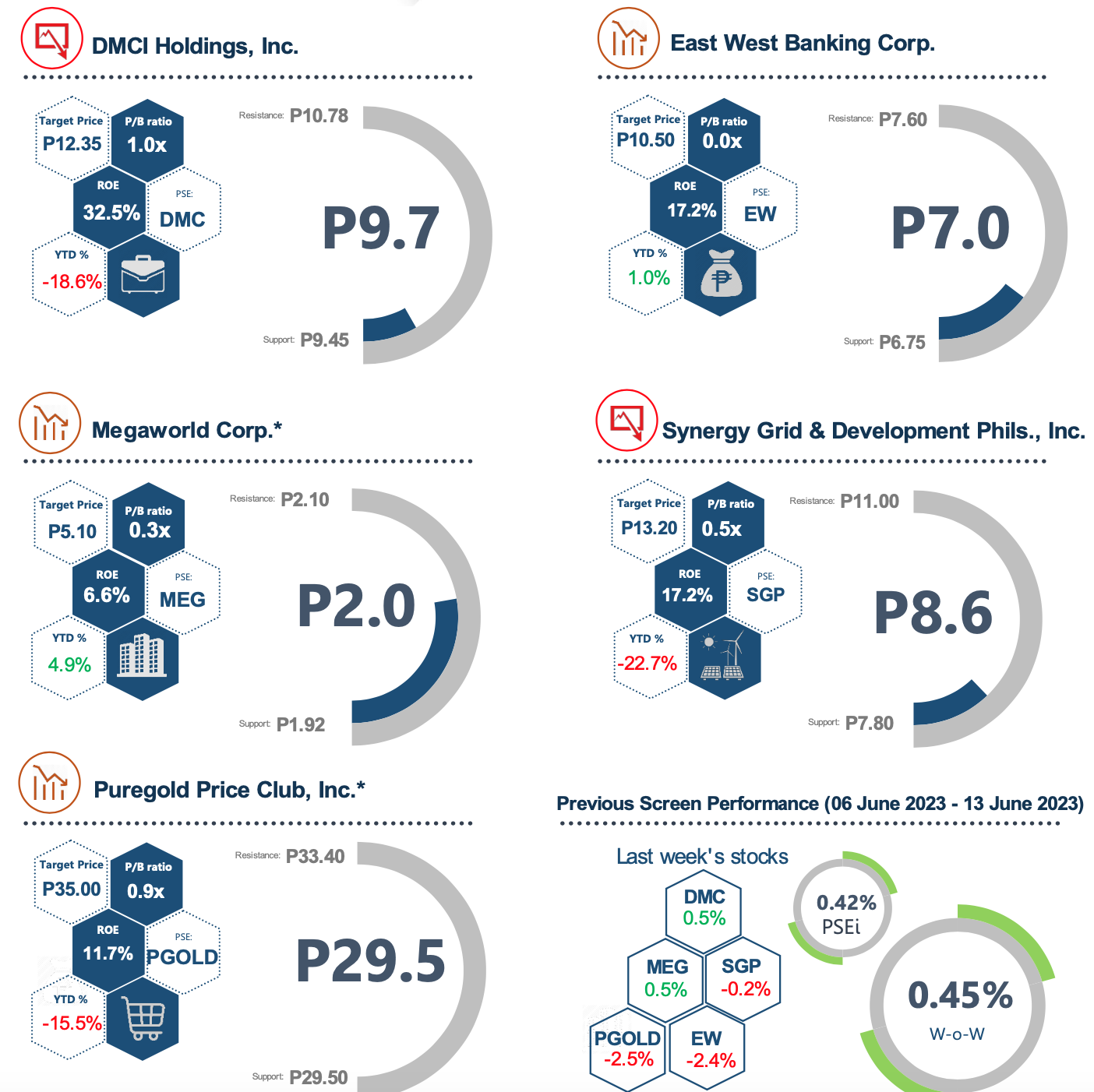

Model Portfolio #2: Value Play

This model portfolio is a collection of stocks that are undervalued by the market but able to provide high return to shareholders. These stocks have low Price-to-Book (P/B) ratio and high Return on Equity (ROE).

| Value Play model stocks portfolio |

| 1. DMCI Holdings Inc. (DMC) |

| 2. East West Banking Corp. (EW) |

| 3. Megaworld Corp. (MEG) |

| 4. Synergy Grid & Dev’t Phils. (SGP) |

| 5. Puregold Price Club Inc. (PGOLD) |

SELL (Removed from last week’s portfolio): No change in stock composition this week

BUY (Newly added to the portfolio this week): No change in stock composition this week

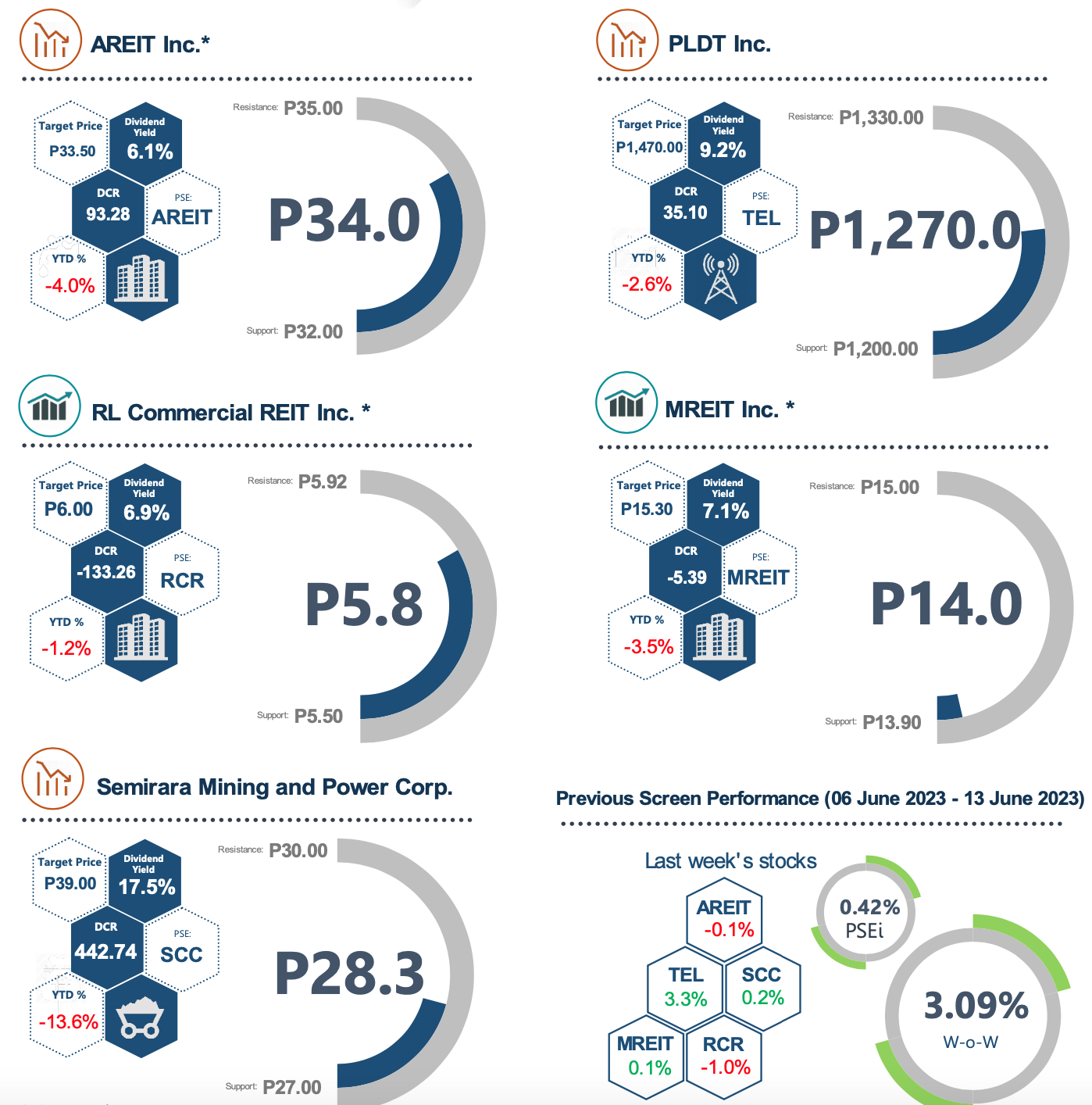

Model Portfolio #3: Yield Seekers

Aside from stock price appreciation, these stocks can also generate above-average dividend yields. These stocks are characterized as having high Dividend Yields and high Dividend Coverage Ratio (DCR).

| Yield Seekers model stocks portfolio |

| 1. AREIT Inc. (AREIT) |

| 2. PLDT Inc. (TEL) |

| 3. RL Commercial REIT Inc. (RCR) |

| 4. MREIT Inc. (MREIT) |

| 5. Semirara Mining and Power Corp. (SCC) |

SELL (Removed from last week’s portfolio): No change in stock composition this week

BUY (Newly added to the portfolio this week): No change in stock composition this week

Model Portfolio #4: Unloved

These stocks could potentially generate high earnings but are currently underrated by the market. These stocks are characterized as having high Earnings per Share (EPS) growth and low Price-to-Earnings (P/E) ratio.

| Unloved model stocks portfolio |

| 1. Manila Water Co. (MWC) |

| 2. Metrobank (MBT) – Newly added to the model portfolio this week |

| 3. Bank of the Philippine Islands (BPI) |

| 4. Security Bank (SECB) |

| 5. GT Capital Holdings Inc. (GTCAP) |

SELL (Removed from last week’s portfolio): BDO Unibank Inc. (BDO)

BUY (Newly added to the Model Portfolio this week): Metrobank (MBT)

Whatever type of investor you may be, we’ve got the Model Stocks Portfolio for you.

Happy smart investing!

This report is prepared by PinoyInvestor’s partner broker below. Find out more about our partner brokers and sign up to avail their complete trading brokerage services.

Commentary: US slaps PHL with 20% tariff rate, now what?